Blog

More About Kai-Zen™

Creating Tax Free Wealth For Business Owners

Discover How the Ultra-Wealthy Legally Avoid Taxes

Taxes are one of the biggest expenses most people face, but did you know that some of the wealthiest individuals often pay little to no taxes—completely legally? It’s not about loopholes or shady tactics; it’s about understanding and applying the same tax-free wealth strategies that have been available for decades. The good news? These strategies aren’t just for the ultra-rich—you can use them too.

Don't Leave Your Future to Chance: Utilize Our Retirement Analyzer Now!

FinancHow You Can Benefit From Legally Minimizing Your Taxes

Here are three key ways the wealthy legally pay little to no taxes—and how you can apply the same strategies:

1️⃣ Real Estate Tax Benefits – The wealthy invest in real estate because it offers powerful tax advantages. They use depreciation to reduce taxable income and 1031 exchanges to defer capital gains taxes when selling properties. You can leverage these same strategies to grow your real estate portfolio tax-efficiently.

2️⃣ Business Ownership & Deductions – Business owners have access to deductions that significantly lower their tax burden. From home office deductions to strategic expense write-offs (such as travel, equipment, and even meals), entrepreneurs can legally reduce taxable income. Even starting a side business can open doors to these tax-saving opportunities.

3️⃣ Tax-Free Investment Accounts – The ultra-wealthy utilize tax-advantaged accounts like Roth IRAs, Health Savings Accounts (HSAs), and life insurance strategies to grow wealth tax-free. By shifting investments into these vehicles, you can also minimize taxes and maximize long-term financial security.

The key is knowing which tax strategies apply to you. Whether it's utilizing Roth IRAs, leveraging 1031 exchanges for real estate, or using business deductions wisely, there are ways to legally reduce your tax burden and build long-term wealth. With tax laws evolving, staying informed is crucial.

Stay informed by following tax professionals, consulting a CPA, and keeping up with trusted financial resources like IRS updates, tax strategy books, and expert.

Don't Leave Your Future to Chance: Utilize Our Retirement Analyzer Now!

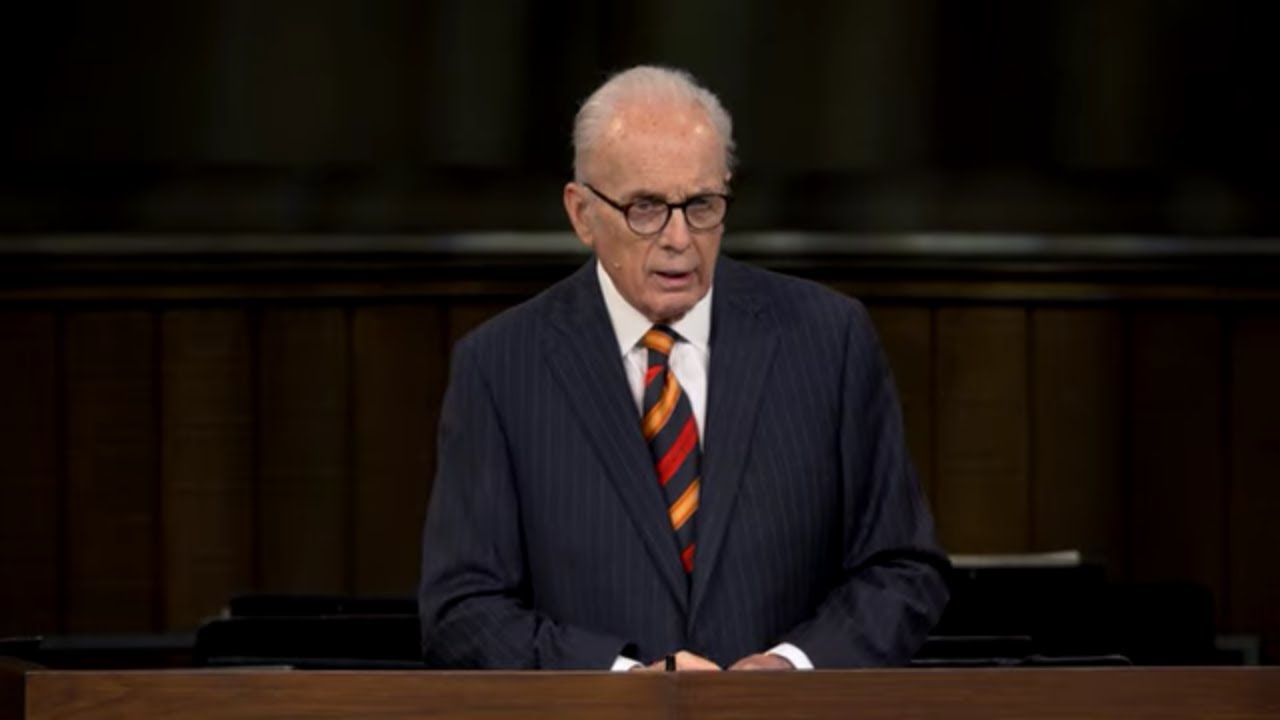

FamilThe Unfailing Promises of God

John MacArthur explores the steadfastness of God's promises as revealed in Scripture. Drawing from various biblical passages, he emphasizes that God's assurances are unwavering and trustworthy, providing believers with a foundation of hope and confidence. MacArthur delves into the nature of these divine promises, illustrating how they have been fulfilled throughout history and continue to offer guidance and comfort to Christians today.

The importance of understanding and trusting in God's commitments, especially in times of uncertainty. By reflecting on selected scriptures, MacArthur encourages believers to deepen their faith and reliance on God's unchanging word. He highlights that, unlike human promises which can falter, God's promises remain constant and are a testament to His eternal faithfulness. This message serves as a reminder of the enduring nature of God's word and its relevance in the lives of believers.

Creating Tax Free Wealth For Business Owners

Kai-Zen was first introduced in 2012 by NIW. The underlying financial approach has been utilized by wealthy individuals and estates (typically $10M and over) since the 1960s. Kai-Zen is a new variation on this approach - allowing highly compensated individuals like yourself to participate in this type of leveraging for the first time.

Learn More About Kai-Zen™

Take Comfort in Understanding Your Strategy!

No one knows what will happen in the future but looking at the past uncovers some common patterns. Stressing our designs through some of the harshest economic conditions to date allows us to implement a strategy to help protect against potential future failures and optimizes our chances for a more successful outcome.

"Let us not become weary in doing good, for at the proper time we will reap a harvest if we do not give up."

- Galatians 6:9 (NIV)

Home

Our Story

Kai-Zen™

Resources Center

Unlock the path to tax-free wealth and watch your business flourish like never before.

An Independent Licensed Agent Representing NIW Companies, Inc. Creators of The Kai-Zen Plan

Cornell Financial Group © Copyright 2024 | All Rights Reserved