Kai Zen™ Consultation: The Retirement Analysis

During the Retirement Analysis, we will assess four key areas of your financial life, providing a comprehensive overview of your financial health and retirement planning. This in-depth analysis is designed to help you make informed decisions about your retirement strategy, ensuring all aspects of your finances are considered. As part of the session, you'll also receive a complimentary Kai-Zen™ Benefits estimate, giving you insights into retirement solutions.

What 4 areas are included in your Kai Zen™ retirement analysis?

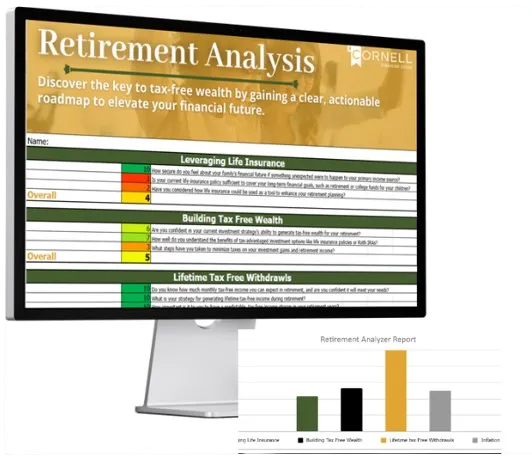

Building Tax Free Wealth

This section will focus on strategies to accumulate wealth in a tax-advantaged way, allowing you to grow your nest egg without unnecessary tax burdens.

Assess the investments in your portfolio and identify those that provide tax benefits, such as municipal bonds or index funds, to maximize after-tax returns.

Utilizing Tax-Advantaged Accounts: Explore the benefits of using accounts like Roth IRAs and Health Savings Accounts (HSAs), which allow for tax-free growth and withdrawals under certain conditions.

Evaluate your current income sources and investment gains, ensuring that you are implementing strategies to minimize taxes and maximize the wealth accumulation potential.

Secure your financial freedom by minimizing taxes and unlocking greater growth potential for your retirement and beyond.

Inflation Protection

Ensuring your retirement savings maintain their purchasing power is essential. We'll show you how to build inflation-protected income streams to safeguard your future.

Evaluate how well-prepared you are to handle the impact of inflation on your retirement savings.

Consider the measures you’ve implemented to ensure that your income keeps pace with inflation during retirement..

Reflect on whether your current financial plan is strong enough to protect your purchasing power as inflation continues to rise.

You'll enjoy peace of mind knowing your purchasing power is protected, no matter how the economy shifts.

Leveraging Life Insurance

This section will focus on leveraging life insurance to build tax-deferred wealth, provide tax-free retirement income, and ensure a tax-efficient transfer of wealth, all while protecting your family.

Looking at the types of investments in your portfolio and their tax implications.

Evaluate how satisfied you are with the level of insurance coverage you have for your retirement plan, including your life insurance policy.

Assess the steps you’ve taken to minimize taxes on your investment gains and retirement income.

Secure your financial freedom by minimizing taxes and unlocking greater growth potential for your retirement and beyond.

Lifetime Tax Free Withdrawals

We'll analyze how you can access your funds during retirement without triggering taxes, helping you maximize your retirement income.

Examine the advantages of accounts such as Roth IRAs and Health Savings Accounts (HSAs), which enable tax-free withdrawals in retirement, thus aiding in wealth preservation.

Looking at the timing and method of your withdrawals to maximize tax efficiency and ensure a consistent income stream throughout your retirement.

Investigate how leveraging permanent life insurance policies can offer tax-free loans or withdrawals from the cash value, enhancing your withdrawal strategy while providing protection for your beneficiaries.

This financial stability will empower you to enjoy your retirement without worrying about taxes draining your savings.

BONUS: Kai-Zen™ Benefits Assessment

The Kai-Zen™ Benefits Assessment is a powerful tool that helps you maximize your financial potential by leveraging borrowed capital. With Kai-Zen™, you can add up to 3x more money to your retirement plan, increasing your investment capacity and potential returns by 60-100% compared to traditional self-funding. This strategy also offers tax-free growth, allowing you to protect and grow your wealth efficiently.

Kai-Zen™ maximizing your wealth while providing protection on your growth.

The success of your retirement depends on the amount you save, not on your rate of return. A unique cash accumulation life insurance policy using leverage offers an opportunity to earn interest and eliminate the risk of market declines, while providing you and your family protection. The policy secures the loan, providing you the potential for an additional 60-100% more for your retirement without the typical risks associated with leverage.

Home

Our Story

Kai-Zen™

Resources Center

Unlock the path to tax-free wealth and watch your business flourish like never before.